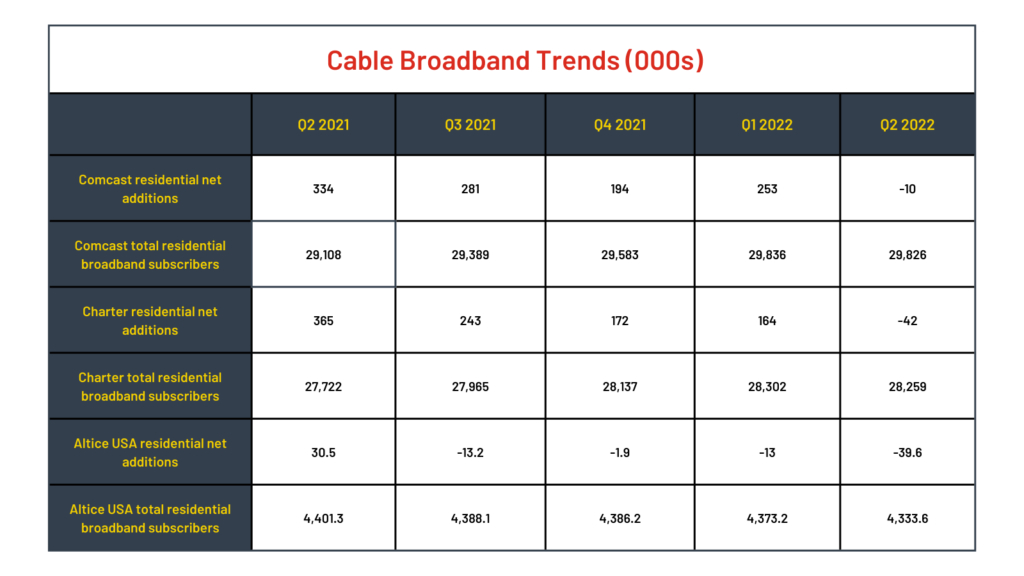

Cable operators struggled through a tough quarter of broadband subscriber growth in Q2, with Comcast reporting flat growth (negative on the residential side), Charter sliding into the negative, and Altice reporting its fourth consecutive quarter of losses. All three cable operators attributed some of their struggles to the same issues: low move activity combined with the lingering effects of the pandemic, but there was also acknowledgement that fiber and fixed wireless expansions have begun to cut into cable’s broadband subscriber base.

Impact: Comcast reported flat broadband subscriber growth for the first time ever in Q2, but only because gains on the business side offset a 10,000-subscriber loss in residential customers. Without those business additions, we’d be talking about a negative quarter of broadband growth for all three major U.S. cable operators. While Comcast eked out flat growth, Charter’s results went fully negative as the company reported a combined broadband loss of 21,000 customers due to the loss of 42,000 subscribers on the residential side. Altice’s quarterly results reported the following week were much the same – the company lost 40,000 residential broadband subscribers in the quarter.

Not only did Comcast report flat broadband growth for the first time ever, Q2 was only the second time the cable operator has reported quarterly gains of fewer than 100,000. While a slowdown in broadband growth had been expected, the trajectory was a little steeper than expected, as Q2 analyst estimates had hovered around 84,000 additions. Comcast said it’s working to combat the static move activity and current economic conditions by expanding its footprint through edge-outs, per CEO Brian Roberts. MoffettNathanson calculated that the cable operator added 226,000 new homes passed in Q2 through this strategy, a 4.1% year-over-year increase, and the company is actively pursuing both state and federal broadband grants to help extend its footprint. But both Roberts and Cable CEO Dave Watson also acknowledged that fiber expansion and fixed wireless growth are putting pressure on cable broadband providers, with FWA having some impact on Comcast’s ability to connect new customers. But the company as a whole does not think FWA will have a long-term effect on its business; rather it is new and adding pressure on wireline providers as part of the technology’s “launch phase,” as Watson put it.

Charter’s explanation for the losses varied a little in that the company said its numbers included the disconnection of 59,000 customers who rolled off government subsidy programs. According to CFO Jessica Fischer, who had predicted positive broadband growth in Q2 as late as June, without the loss of those customers, Charter would have reported 38,000 broadband net additions. CEO Tom Rutledge continued to project optimism about his company’s broadband model and like Comcast, acknowledged fiber and fixed wireless as factors but not the most significant things impacting Charter’s subscriber growth. Rutledge remains firm in his believe that when market levels return to normal post pandemic, Charter will see its broadband growth return to positive levels. To combat the slowdown, Comcast is focusing on its rural buildout strategy, fueled in part by federal RDOF funding and going after state broadband grant opportunities where possible. It also continues to upgrade its network so that it can launch symmetrical multi-gigabit speeds to better compete with fiber.

Altice’s broadband growth first took a negative turn in the third quarter last year when the company lost 13,100 customers. It then was able to stem those losses in Q4 to only 1,900 but then closed 2021 down 13,000 subscribers fewer than it had at the start of the year. It then lost another 13,000 customers in this year’s first quarter before the nosedive in Q2, which was double the number of losses predicted by industry analysts and reportedly its largest quarterly broadband loss ever. CEO Dexter Goei was more optimistic than one would expect on the call, however, and said the company is starting to see improved results from its investments in fiber that will help turn its broadband fortunes around. Altice reported 23,000 fiber net additions to push its fiber customer base up to 104,000 and accelerated its fiber network build, adding 270,000 new fiber passings in Q2 for a total of nearly 1.6 million fiber locations within its footprint. But Goei also acknowledged that the report about Altice shopping its Suddenlink assets was true, although he declined to reveal any details about a potential sales process.

As the pandemic continues to linger, cable operators are going to have to continue finding innovative ways to combat the economic factors impacting their ability to add new broadband customers. For Altice, that means leaning into fiber and perhaps selling off a significant chunk of its footprint that it doesn’t feel works strategically with the rest of its business. For Comcast and Charter, the wave of fiber deployments sweeping the country and meteoric fixed wireless growth will further exacerbate the issues they’re facing, at least in the short term. But both companies seem confident they can compete and win head-to-head against fiber and that FWA is more flash in the pan than a long-term competitor. And there’s no doubt all three will be extremely active in chasing down the influx of federal broadband funding coming down the pike once the BEAD program starts doling out money to states to bridge the digital divide and achieve universal high-speed broadband coverage.