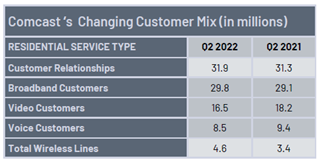

Comcast’s Q2 earnings report lays bare why well-diversified media companies tend to weather economic storms and business challenges better than others over the long term. Yes, Comcast’s stock ended Thursday down more than 9% and continued to decline into Friday morning. Yes, the company lost 497,000 video subs in the quarter, far worse than the 364,000 it lost in Q2 2021 when its video subscriber base was nearly 2 million more than today. Yes, it was the first time Comcast failed to add to its broadband rolls, losing 10,000 residential subs in the quarter. But Comcast still has 16.5 million residential video and nearly 30 million residential broadband customers, respectively, and its total customer relationships (34.4 million) are still more than they had a year ago.

Comcast’s Q2 earnings report lays bare why well-diversified media companies tend to weather economic storms and business challenges better than others over the long term. Yes, Comcast’s stock ended Thursday down more than 9% and continued to decline into Friday morning. Yes, the company lost 497,000 video subs in the quarter, far worse than the 364,000 it lost in Q2 2021 when its video subscriber base was nearly 2 million more than today. Yes, it was the first time Comcast failed to add to its broadband rolls, losing 10,000 residential subs in the quarter. But Comcast still has 16.5 million residential video and nearly 30 million residential broadband customers, respectively, and its total customer relationships (34.4 million) are still more than they had a year ago.

Meanwhile, wireless revenue was up 30%. Business services revenue was up 10.1%. Studios and Theme Parks revenue soared 33.3% and 64.8%, respectively. Now granted, all those revenue baskets added up to $7.9 billion, which pales in comparison to the $11.5 billion represented by video and broadband. But the growth numbers are impressive nonetheless, softening the blow as the once core video business continues to decline and now even mighty broadband faces market saturation and unprecedented competition in the U.S. Comcast’s extremely diversified portfolio gives the company breathing room during these uncertain times. Rumors this week that Comcast might even be talking to Vizio about buying the Smart TV player only feed into this narrative: Ensure easy access to your products and services no matter how and where customers want to access content. And as we’ve noted before, Smart TVs are the last couple yards to consumer eyeballs.

As for Peacock, it remains a strange bird: After adding a whopping 4 million subs in Q1 (up 44% sequentially), the streamer was flat to down in Q2 with 13 million subs. Those paid subs are part of the 27 million overall monthly active accounts that include people who get free access through their Xfinity bundles. But that’s down one million MAAs from what Comcast reported in Q1, and considering that it only shed half a million video subscribers, it’s interesting that it lost twice that number of Peacock MAAs with no increase in paid subs. That suggests that cord cutters and others who lost their free access to Peacock weren’t broken up enough about it to turn around and sign up as paid subs.

As for Peacock, it remains a strange bird: After adding a whopping 4 million subs in Q1 (up 44% sequentially), the streamer was flat to down in Q2 with 13 million subs. Those paid subs are part of the 27 million overall monthly active accounts that include people who get free access through their Xfinity bundles. But that’s down one million MAAs from what Comcast reported in Q1, and considering that it only shed half a million video subscribers, it’s interesting that it lost twice that number of Peacock MAAs with no increase in paid subs. That suggests that cord cutters and others who lost their free access to Peacock weren’t broken up enough about it to turn around and sign up as paid subs.

Sure, Peacock’s lack of original hits could be at fault. But the fact that much of NBCUniversal’s high-value library content remains chained by licensing deals with other streamers isn’t helping it grow subs despite that stellar Q1 fueled by the Olympics and the Super Bowl. Comcast Chairman & CEO Brian Roberts told investors that “we look forward to a very strong fall” when Peacock will wrestle back next-day NBC broadcast rights from Hulu, and “we’ll be able to take full advantage” of keeping more in-house. “We’ll also have Sunday Night Football, Premier League, the World Cup, and more originals,” he noted. Considering how much the Olympics-Super Bowl combo juiced Peacock growth in Q1, Roberts may be onto something there. Also recall that Peacock booked $1 billion in advertising commitments into early 2023, twice what it booked last year and about 14% of NBCU’s $7 billion Upfront haul. In fact, much of NBCU’s 3.6% growth in media revenue stemmed from Peacock’s $444 million in revenue, which was nearly 4X higher than the same quarter last year. It wasn’t enough to offset the streamer’s adjusted EBITDA loss of $467 million, but despite all the challenges, Peacock’s revenue growth and Madison Avenue support is encouraging for a service that faces plenty of headwinds as it bides time waiting for all its valuable, licensed IP to return to the mothership, free from services like Hulu (which Comcast will likely exit in 2024 with a massive multi-billion payday when it forces Disney to buy back its 33% stake).

The truth is that Peacock didn’t rush into the market and has since refused to go full throttle at the expense of its legacy content businesses, unlike some other media companies that did the opposite (with some starting to regret it). During Comcast’s earnings call, NBCU CEO Jeff Shell noted that “we had the benefit of studying the market before we came in” and always viewed Peacock as “an extension of our existing business, not a new business based on a dual revenue stream of subscription and advertising. And I think everybody kind of moving in that direction is the validation of that business model.” Time will tell whether Wall Street continues to hammer Comcast’s stock in the coming days or ultimately buys into Shell’s premise. But diversification means that the future doesn’t rest on Peacock’s shoulders. Or cable. Or broadband. Or wireless. With good diversification, there’s plenty of revenue to go around.