The complicated relationship between privately owned Windstream and publicly held Uniti has taken another turn, with the two companies announcing plans to reunite as one, with a focus on fiber deployments in Tier 2 and Tier 3 markets.

Impact: The deal comes nine years after Windstream spun off Uniti in 2015 as a real estate investment trust and has an estimated price tag of $13.4 billion, which comprises approximately $4.4 billion in company revenue, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. Windstream shareholders, including Elliott Management and other former creditors, will receive $425 million in cash, $575 million in preferred equity in the new company, and common shares representing 38% of the outstanding common equity of the combined entity. The remaining 62% of shares will go to Uniti shareholders. Expected to close in the second half of 2025, the re-merger will reunite Windstream’s Kinetic fiber-to-the-home business with Uniti’s national wholesale owned fiber network, creating a publicly held company under the Uniti name that a joint press release described as a “premier insurgent fiber provider.”

The merger will bring the relationship between the two companies full circle, albeit with Uniti now in control. Windstream spun off Uniti, then known as Communication Sales & Leasing, in 2015 to reduce its debt by $3.2 billion and increase free cash flow. But the structure of that deal set off years of litigation between the two companies and also involved Windstream’s bond holders, precipitating Windstream’s slide into Chapter 11 bankruptcy in 2019 before emerging more than a year and a half later with an enterprise and fiber focus. Even through all that, however, the two companies remained intertwined, with Windstream leasing fiber from Uniti as its largest customer and Elliott owning a majority stake in Windstream as well as all of Uniti’s equity and debt.

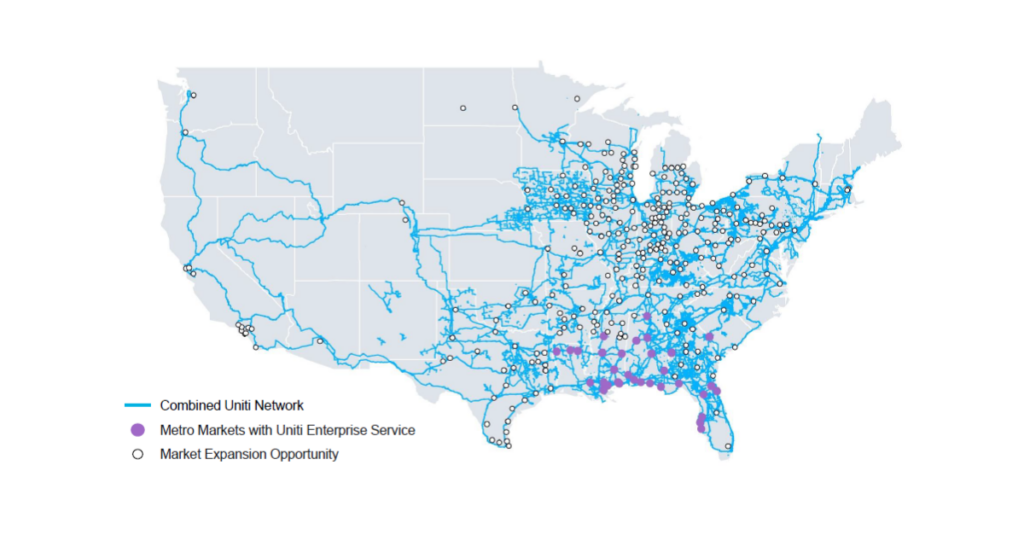

A joint press release touted the strategic and financial benefits of the combined entity, which will be led by Kenny Gunderman and Paul Bullington, Uniti’s current CEO and CFO, respectively, with key members of Windstream’s management team expected to stay. Post merger, Uniti will lose its REIT status but end up with approximately $4 billion in revenue and initially serve more than 1.1 million customers in 47 states, primarily in the Midwest and Southeast. An initial footprint of approximately 1.5 existing homes passed thanks to Windstream’s fiber expansion strategy the last several years combined with the expected enhanced free cash flow will position Uniti to expand its residential fiber buildout by up to 1 million households. The combined company will target Tier 2 and 3 markets that offer less competition than larger Tier 1 markets with multiple incumbent providers and overbuilders as it looks to become a more influential nationwide fiber player.

According to Gunderman, the merger will benefit Uniti, which owns wireless towers and fiber operations, by removing “dis-

synergies that exist in the current landlord/tenant relationships” and obviating financial risks from master leases that go up for renewal in 2030. Furthermore, projections show the combined entity could produce up to $100 million of targeted annual operating expense synergies and $20-$30 million of targeted annual capex savings within 36 months of closing. This deal should also facilitate a de-levered balance sheet, drive additional value creation to fund strategic initiatives, and enable an enviable “industry leading” $650 average cost per fiber passing. He also said that once combined, Uniti will continue with its current growth strategy combined with residential fiber buildouts, both of which should result in stronger financials.

M&A in the fiber sector appears to be heating up as states prepare to start distributing billions in federal BEAD funding either later this year or in 2025, with the Windstream-Uniti news coming on the heels of T-Mobile’s announcement of a fiber joint venture that includes the acquisition of regional fiber provider Lumos. WideOpenWest also revealed that it had received an unsolicited and non-binding preliminary proposal for DigitalBridge Investments and entities connected to Crestview to purchase all remaining shares of WOW not already owned by Crestview for $4.80 per share. And Consolidated is currently in the middle of selling itself to Searchlight Capital Partners, which already owns nearly 50% of the company, and partner British Columbia Investment Company to accelerate its own fiber expansion strategy. Uniti appears to have seen the writing on the wall and decided to jump in with both feet. As Gunderman said, “the demand for fiber broadband has never been greater, and Uniti is now expanding its reach into FTTH with an attractive scaled platform. We look forward to working with Windstream to create a national fiber powerhouse that will continue to bridge the digital divide for our customers.”