When it comes to media consumption, sports are one of the main driving forces behind audience engagement. In the past year we have seen the battle for the sports media rights explode in competition as RSNs teeter on the brink of collapse and streaming behemoths like Prime Video, Netflix, Peacock, and Paramount+ snap up lucrative deals with major sports leagues, forcing the landscape of sports broadcasting to shift from traditional live feeds to streaming simulcasts and stream-exclusives. It is easy to understand why, as a recent report from Forbes indicated NFL games accounted for 93% of the most watched TV programs in 2023. Whether this evolution of broadcasting is beneficial for the consumer or not remains to be seen, but StreamTRAK®’s Ad Sales data over the past two years paints an interesting picture: The rise of sports on streaming services brings with it a compelling companion in the form of sports betting.

From January 2022 to January 2024, StreamTRAK has amassed more than 10,000 hours’ worth of audits from AVOD and FAST providers. Using this data, we have singled out a total of 350 minutes worth of sports betting or gambling-related ads, 30% of which came from sports-related FAST channels. It’s a small number in comparison to total audited time, but when the average ad time per title is factored in, roughly four minutes for AVOD and 12 for FAST providers, 350 minutes becomes a little more significant as it represents nearly 1% of total ads and total ad duration.

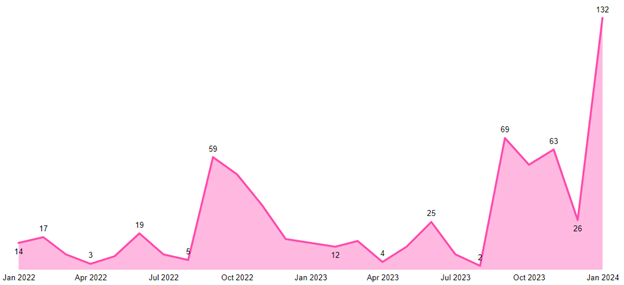

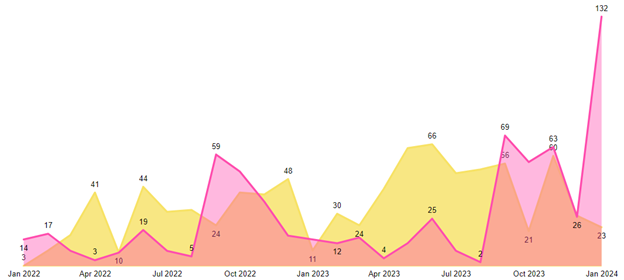

While 1% is small, it is important to take into consideration the growth trajectory of sports betting and gambling ads as the visual above shows. Boosted by the Super Bowl, we clearly see a large spike of ads in December 2023, much higher than the previous year’s “Super Bowl Craze” uptick, which occurs annually beginning around September and October.

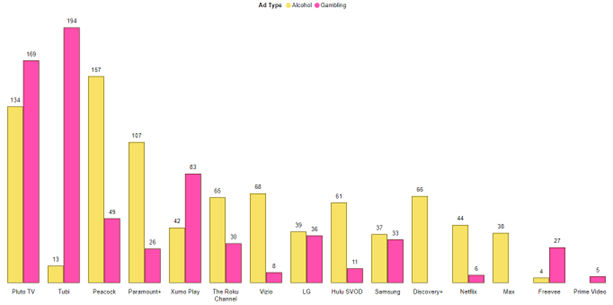

In addition to sports betting and gambling, the other big “vice” ads come from alcohol brands. These are also on the rise as seen in the above trending view. Merging the vices, the share of ad time jumps up another percent to sit around 2% of total ads and ad time. As for the platforms on which these ads appear, Pluto TV has run the most in terms of raw aggregated total between the two types, while Tubi and Peacock hold the top spot for single most gambling and alcohol ads, respectively.

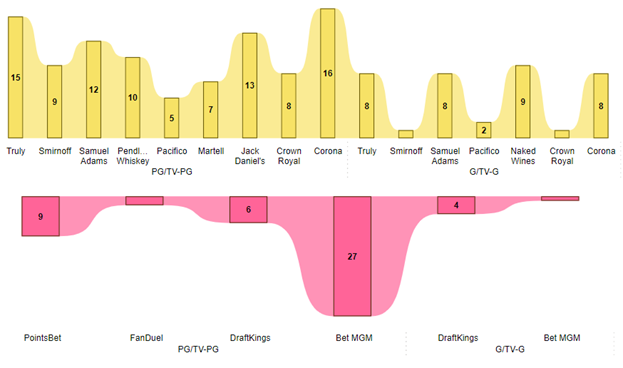

While these ads market legal products, they may concern some if the ads showcasing gambling and drinking appear during ad breaks of content aimed at younger audiences. The prevalence is very low overall, but the data shows several occurrences of “vice” ads appearing on PG/TV-PG rated content and even a handful on content rated G or TV-G.

It’s likely these ad breaks run on algorithms or trigger on a scheduled structure and could feature the same ads in the same order across multiple titles. If this is the case, it isn’t shocking that an ad geared towards an adult audience could appear on content rated PG or lower. It is also important to note that StreamTRAK does not audit the Kids & Family section featured on many providers, and these movies or shows rated PG or lower which feature gambling or alcohol ads are not necessarily “Kid’s” content.

Next? The content of ads is an interesting piece of the advertising pie. While the average duration of ads and the average number of ad breaks can be very useful, diving into what those ads are and gathering more granular metadata aids in expanding our whole understanding of advertising on streaming. In the coming months, expect to see more analysis done on specific types of ads as well as a deeper look into the nature of some of the mobile gaming ads analysts have encountered during audits.