From Dish dropping nearly all RSNs to Comcast’s ongoing disputes with RSNs like Altitude Sports, RSNs have been on the defensive lately. But this is a relatively recent phenomenon. Consider that when Sinclair bought Fox Sports RSNs in 2019 for $10.6 billion, it seemed like a great way to further leverage negotiations with television providers.

But then cord cutting accelerated, followed by the pandemic. No live sports for a year along with fewer subscribers willing to foot the RSN bill meant that the once lucrative income stream was now an anchor around their bottom line. But Sinclair did make a major initial investment in their now-named Bally Sports RSNs, and the news that Bally Sports’ owner Diamond Sports group has defaulted on debt and may be looking at bankruptcy calls out just how much of the US sports market is under the Bally brand. Bally sports operates an RSN in nearly every state in America.

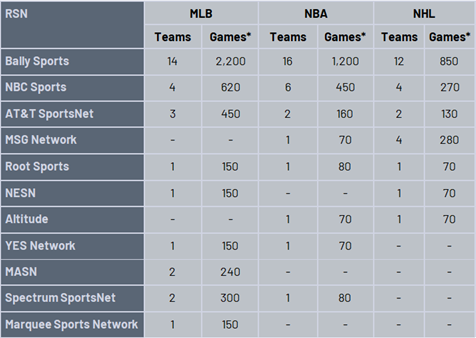

The numbers are staggering when you break them down. Bally airs most games in local markets for 14 of the 29 US based MLB teams, for 16 of the 29 US based NBA teams, and 12 of the 25 NHL teams. This means that in local markets Bally broadcasts nearly 50% of all baseball games, 55% of all NBA games, and 48% of all NHL games. When you combine these with the AT&T Sports Net RSNs that Warner Bros. Discovery wants to offload, the long term remains a question mark.

Unlike the NFL, the NBA, MLB, and NHL have no collective broadcasting deal. And most teams in those three leagues—outside of major markets–do not have the fandom power that any single NFL team commands. With RSNs a major driver of income for teams, cord cutting has hit the bottom line. And while a fan can watch their favorite team by subscribing to something like ESPN+ for NHL games or MLB.tv, they can only watch their favorite team if they don’t live in the local market.

Next? Could the Bally RSNs go to streaming? Maybe. Deals like Apple TV+ streaming all MLS games (in and out of market), as well as ESPN+ carrying out-of-market NHL games suggests an appetite. But the cost-to-income ratio—along with the ability to capture streaming rights from individual teams—may not be quite there. Even Bally’s own attempt at an streaming service didn’t help despite having all local NHL and NBA games and a few MLB team games (a $20/mo price was also steep). Where once RSNs were able to lean on the fees from millions of cable and DBS subs, they would now have to rely on creating those relationships themselves or hope that a streamer would pay the top dollar fees. Whatever the case, the regional sports world is in for a rocky road over the next few years.