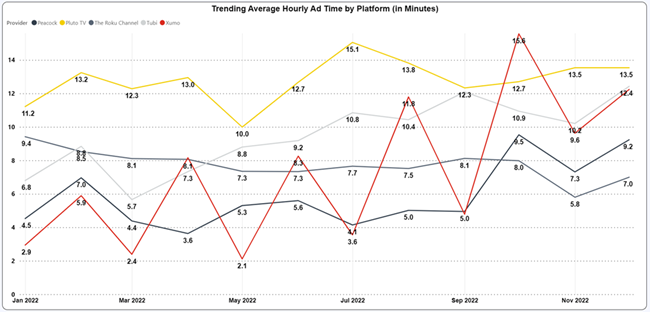

Per ADTRAKER’s findings in 2022, XUMO’s FAST service zig-zagged upwards on the scale that considers hourly average time allocated to advertising. The Comcast-owned service started the year dedicating an average of nearly three minutes per hour to advertising. By year-end that figure had grown more than four-fold to 12.4 minutes per hour. That increase led to XUMO’s rise from having the least time dedicated to advertising to nearly tying for second place with Tubi.

To be fair, some of the variability observed at XUMO and other FAST providers is attributable to the underlying channels audited at each. But even after locking in the underlying channel selection in the latter part of the year, XUMO and the other providers audited exhibited strong variability in their advertising loads. It’s also worth noting that while more time for advertising was observed at XUMO at the end of the year versus the start, a large (though less significant) segment of time remains unfilled. In January, over 90% of advertising time at XUMO went unfilled while in December, 62% of XUMO’s time went unfilled.

XUMO has perennially fallen at the bottom of the heap when considering the percentage of ad time that goes unfilled, an interesting note considering NBCUniversal’s Peacock consistently ranks at the top as a provider that mitigates any unfilled ad time, but it seems things are headed in the right direction at XUMO. Doubtless, Comcast and Charter are working hard in their now joint-venture to not only build a platform that helps consumers seamlessly navigate the fractured video landscape, but also to help build a strong contender in the platform battle that TV makers and digital programmers will seek out for its capabilities on the advertising front. It seems there’s been efforts to carve out a space for ads at XUMO, now it’s just a matter of filling that time.