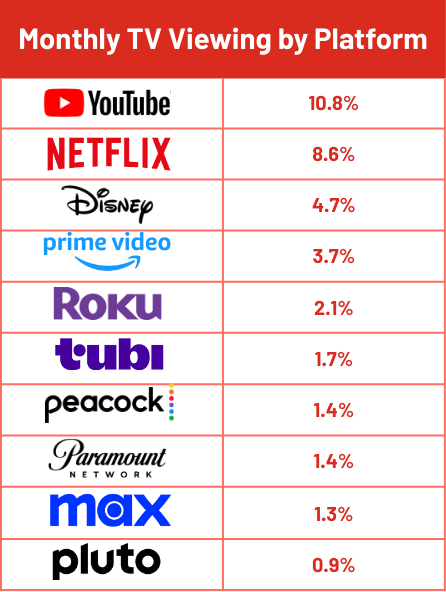

In the Golden Age of Hollywood that ran from the 1920s to the 1950s, MGM and Paramount Pictures dominated with the biggest movies, stars, and box office. Paramount even controlled its own vast theater chain until the U.S. Supreme Court’s 1948 Paramount Decree forced divestiture. Fast forward to today, and the global Internet has largely democratized content distribution – but advantages remain for the largest players with the best marketing, algorithms, and (usually) content. If we just break out streaming from the rest of entertainment, two companies clearly dominate and could gradually steal more share over time: YouTube and Netflix. According to Nielsen, YouTube now captures 10.8% of all TV viewing while Netflix snags 8.6%, meaning that together these two entities account for nearly one fifth of all video viewing.

Interestingly, they operate on quite different business models, but this week reminds us that their ambitions know no bounds. They are coming for new Hollywood, whose major studios continue to grow streaming engagement and revenue but must also manage a legacy content business in transition. And while different, YouTube and Netflix are getting more similar every day.

First things first: A new report in The Information has everyone buzzing because it reveals YouTube will soon launch a significantly redesigned home page for its smart TV-based app (now garnering more than 50% of YouTube’s viewership). The idea is to mix its core user generated content shelves with premium movie and TV series selections that it already promotes as part of its Primetime Channels initiative launched in 2022. But until now, those offerings lived within a separate menu that required users to proactively seek them out; now the offers will integrate into the homepage recommendation shelves that drive most of YouTube’s viewing traffic. The change could give YouTube the best of both worlds, as it already dominates with 1 billion monthly viewing hours on smart TVs alone – and now it will be able to presumably drive even more new revenue through its commissions from selling movies, shows, and streaming subscriptions. But even more importantly, better integration of UGC and premium content will drive more engagement and keep those viewers within the YouTube universe for longer periods. YouTube not only competes with other streaming and social media options; it also faces off against the big smart TV operating systems from LG, Samsung, and Vizio. The more YouTube can corral users into the its own walled garden, the more advertising it can sell and affiliate fees it can capture. Kurt Wilms, YouTube’s senior director of product management, didn’t mince words when he spoke to The Information: “The vision is that when you come to our [TV] app and you’re looking for a show, it’ll just blend away whether that show is from a Primetime Channel or that show is from a creator.”

Meanwhile, Netflix made its own waves this week as its CFO Spencer Neumann told the Morgan Stanley conference that “we’re not anywhere near a ceiling” on content spending even though Netflix will spend a record $18 billion on content in 2025. While it wasn’t a huge revelation (Netflix execs have long said they will up spending in line with revenue while growing margins), Neumann’s characterization that the company isn’t even close to leveling off its spending turned some heads, especially as many of Netflix’s streaming peers hold the line on costs and have increasingly relied on spreading the same content costs across legacy and streaming platforms with a double-dipping strategy. Netflix simply has a cleaner business model with one content platform that relies on serving thousands of micro-niches across the globe – essentially giving every user just enough relevant content to keep them from churning out. “We have margin targets that we’re trying to deliver,” explained Neumann, “so we can back into how we support the business, what’s left over for content. That’s why we want to grow margins each year – sometimes a little more, sometimes a little less – depending on the kind of in-year investment opportunities.” So because Netflix is a pure-play streamer, its business is relatively simple: Assess revenue, grow margins a bit, spend what’s left over – repeat. Most Hollywood studios would kill for such simplicity.

Next? There’s some good news for the traditional studios now transitioning their core business to streaming: The dominance of YouTube and Netflix could be a short-term phenomenon that will erode over the next few years. That’s because the traditional studios will eventually reach equilibrium with their cable networks (or fuse them into larger portfolios to manage substantial but dwindling cash flow over time). And the theatrical movie business – while extremely challenged amid the post-COVID hangover – will likely find its footing at some point and reassert itself as a more significant part of the content ecosystem. If you look at the Nielsen data over time, TV viewing trends for streaming have bounced around the 40% and low-40% ranges for the last several months (although up from 36% a year ago), suggesting that its growth of the pie relative to other platforms like broadcast and cable may be starting to slow. So while streaming remains the center of the content universe, the more traditional platforms continue to hold their own with a chance to resurge somewhat. New linear-streaming bundling strategies by Charter, Comcast, and others could help stabilize the market in the coming quarters. But for now, YouTube and Netflix sit atop their own dual thrones.