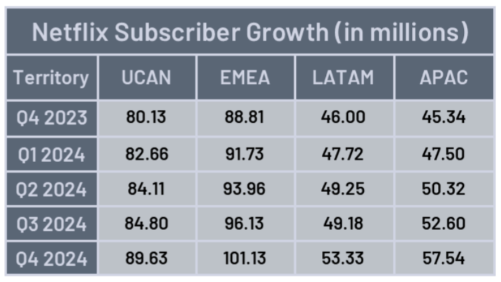

Does Netflix even know how to fail? It made a valiant effort in April 2022 when it reported a loss of 200,000 subscribers and projected more pain ahead. But since then, the company has rebounded and then some, this week reporting the addition of 18.9 million subscribers in Q4 as it exceeded $10 billion in revenue (and $39 billion for the year). Netflix has utterly failed… to fail. And for many competitors that must navigate the transition from the legacy TV business to a streaming-centric marketplace, Netflix’s unstoppable ascension just seems patently unfair. Of course, the company remains sympathetic in its own cagey kind of way, exclaiming in its quarterly Shareholder Letter that “we’re fortunate that we don’t have distractions like managing declining linear networks and, with our focus and continued investment, we have good and improving product/market fit around the world.” Oh, do you, now? Apparently so, as Netflix entered 2025 with 301.6 global subs, reaching every corner of the globe except for a few outliers like China, Russia, Iran, and North Korea. (To deny the North Koreans “Squid Game” seems unnecessarily cruel, but we digress.) At one point during the summer of 2022, Netflix’s stock dipped to below $180 per share. This week, its shares were flirting with the $1,000 mark.

Perhaps Netflix’s ineptitude at failing explains why the company shrugged its way through another price hike this week. What are subscribers going to do? Cancel? More likely ad-free tier subscribers will either shake off the $2/mo increase to $17.99/mo for the Standard plan and $24.99/mo for Premium or simply downgrade to the ad tier, which by the way also went up to $7.99/mo from $6.99/mo – although that’s the first increase for the ad tier since it launched in late 2022.

Starting this quarter, Netflix will no longer report its sub numbers (other than milestone announcements) , but it will have plenty of other metrics to throw in competitors’ faces, including net income that has soared by 61% from $5.4 billion in 2023 to $8.7 billion in 2024. Most of Netflix’s rivals would relish any consistent positive net income on streaming, much less growing profits by nearly two thirds in one year. All of this is why the company can spend on original shows that “delighted our members,” as execs constantly trumpet, while keeping its spend below levels that would hurt operating margins that skyrocketed from 20.9% in 2023 to 27.4% last year. Future margins could exceed Netflix’s own 2025 forecast of 29% if most users absorb the hikes because they simply can’t live without “Bridgerton.” And honestly, some of them cannot.

Next? It may be hard to believe considering Netflix’s stellar performance recently, but the company actually has more runway ahead of it in two areas it has yet to fully crack: Live programming and gaming. As for live content, in 2025, Netflix made strides livestreaming the highly promoted Mike Tyson-Jake Paul boxing match in November and two NFL games on Christmas Day, with some estimating those events on their own added more than 2 million subs. And on Jan. 6, Netflix aired the first weekly edition of WWE’s Monday Night Raw that will further hone its livestreaming chops in 2025. That could lead to more aggressive sports rights acquisitions – although you wouldn’t know it from Netflix co-CEO Ted Sarandos, who has long swatted away that notion and told analysts this week that any success in live “doesn’t really change the underlying economics of full-season, big league sports being extremely challenging.” But leaving the door open, he said “if there was a path where we can actually make the economics work for both us and the league, we certainly would explore.” Sarandos also declined to address speculation that Netflix might bid for UFC rights this year based on its WWE experience (both are owned by TKO Group Holdings), but he did note that WWE Raw is “off to a great start.” Bagging UFC – or even significant sportsrights from a big sports league – could put Netflix on the sports map and potentially sustain its sub growth for years. Did we mention that Major League Baseball will start taking bids in 2028 when current deals expire?

As for gaming, Netflix has really only dabbled. But co-CEO Greg Peters told investors that “we’re going to be focusing on more narrative games based on Netflix IP” such as recent titles like “Squid Game: Unleashed,” which he said “validates our Netflix game formula” as “this virtuous cycle between linear content and simultaneous game offerings.” Of course, others have found mixed results turning hit shows into successful video games. Perhaps Netflix – with more than 300 million homes logging in multiple times per week – might gain more traction with TV-based games designed for kids and families. “We think of this as a successor to family board game night or an evolution of what the game show on TV used to be,” Peters said. “So we’re excited about delivering some cool experiences in that space.” In the end, Netflix has plenty of levers at its disposal, including areas like sports and gaming that can capitalize on its massive global reach. And with margins growing, it’s even more impressive that Netflix plans to spend $18 billion on content in 2025, up $1 billion from 2024 levels. With many of its competitors pulling back on content spend amid belt tightening, Netflix remains an outlier that at this point seems too big to fail. Of course, we’ve heard that one before. Vigilance, Netflix. Always vigilance.