As summer nears its end and holiday content gears up to sleigh its way into every nook, cranny, and chimney of your streaming platform’s homepage, it seems like a good time to hunker down, put on our analyst caps, and dive into the state of AVOD advertising for the first half of 2023.

Between January and July, StreamTRAK auditors collected data from 13 AVOD providers, with nine titles from each provider, amounting to a total of 273 movies and 546 shows audited for the first half of 2023. Across all 819 titles we have encountered 8,470 individual ads, 1,231 unique brands, and 196,905 seconds (or 2,382 minutes or 55 hours or 2.3 days, etc…) dedicated to showcasing those ads.

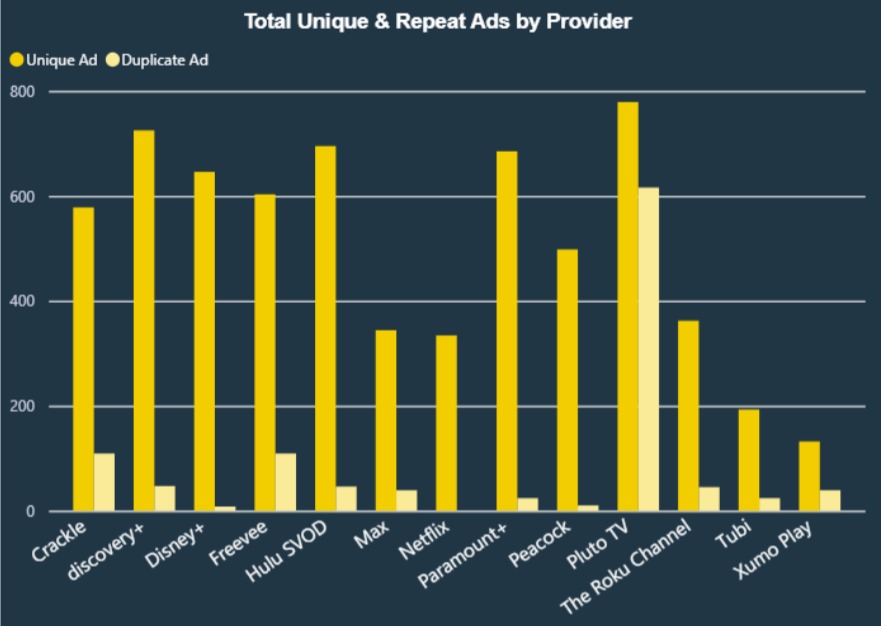

Using this data we can extract trends such as the share of unique vs repeat ads on each AVOD platform. As the data shows, not all AVODs are created equal, the most significant differentiating factor being whether the service is free or paid. Free services, on average, show 370% more repeat ads per title. In other words, viewers are nearly four times as likely to see a repeat ad on a free streaming service (i.e., Crackle, Freevee, Pluto TV, The Roku Channel, Tubi, or Xumo Play) than they would on an ad-supported tier of a paid service like Peacock or Max. Netflix, with ads, interestingly has never shown a single repeat ad (at least during our audits).

The type of advertiser doesn’t differ much between the two groups of AVODs. In each, top advertisers by ad frequency mainly sit within the automotive or financial industries, Capital One making an appearance in both. The data shows Hyundai and Kia as the most advertised vehicles to the “paid tier” audience, while Chevrolet takes the top spot as the most encountered advertiser to the “free” audience. Take from that what you will.

Flipping the script a bit, the average total time per hour that a viewer may have to view ads is virtually the same between the free and paid groups. Free platforms on average run 3.33 minutes of ads per hour, while the paid platforms broadcast 3.12 minutes of ads an hour. It’s only a difference of 10 seconds, although in fairness to the paid platforms it took Usain Bolt only 9.58 seconds to run 100 meters—so maybe 10 seconds is a more impressive time-gap than it first appears.

Next? The Wall Street Journal recently reported a 25% cost increase for ad-free streaming services in the past year alone, but with the rise in popularity of ad-supported tiers we expect to see the subscriber churn rate affect the Ad Sales data. Whether that means an increase in ad loads across the board remains to be seen, but hopefully paid services will retain their devotion to showing few (or in Netflix’s case, no) repeat ads.