Whether it’s the implosion of the RSN ecosystem or the gradual migration of sports content to streaming platforms, the entire TV sports infrastructure is experiencing its biggest sea change since the launch of ESPN in 1979.

The turmoil threatens to upend the economics around live sports, even as leagues continue to extract more money than ever from outlets (and split rights strategically to maximize their paydays). The chaos means a big opportunity for streamers willing to pay billions for rights, with YouTube stealing NFL Sunday Ticket from DirecTV, Apple TV+ recently snagging exclusive rights to stream MLS soccer games, and Amazon Prime paying more than $1 billion per year for Thursday Night Football. And yet live sports on linear TV remains a powerhouse, with Fox Corp. among companies leveraging old-school traditional TV with some success.

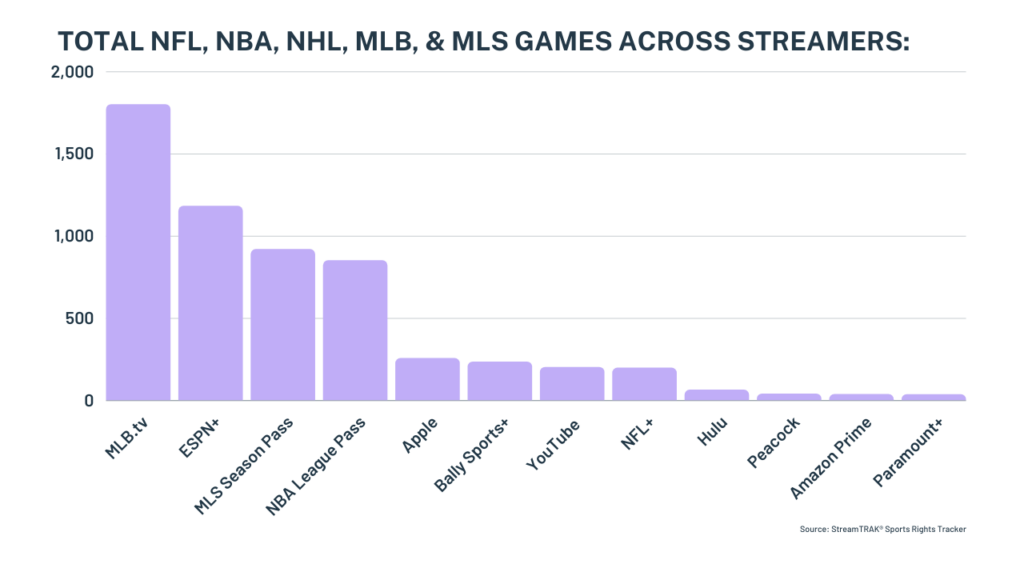

All these recent changes inspired our analysts to create StreamTRAK’s® Sports Rights Tracker, which organizes sports rights complexities into an easy-to-use series of interactive dashboards tallying up games, tracking RSN availability across the country, and mapping out local sports rights across DMAs in the U.S. In a new DeepDIVE report, “The Sports Multiverse of Madness,” OTI found that NFL, NBA, NHL, MLB, and MLS games can vary across streamers, with MLB.tv carrying the most total games owing to baseball’s heavy volume vs. other sports and Apple TV+ barely edging out YouTube in terms of total number of games across the above-mentioned leagues. Bally Sports+ currently touts higher game volume than YouTube TV (as well as Hulu, Peacock, Amazon Prime, and Paramount+), but that’s sure to change if the crisis befalling Bally Sports owner Diamond Sports continues to get worse and more games revert to the leagues for new rounds of dealmaking.

Next? Looking at the variables and risk factors involved, we see four outcomes co-existing in some fashion as the various players try to figure out how to keep a good thing going – even if the viewership and platform patterns are in major flux. 1) The leagues take a heavier hand putting more games on their own streaming services, although this seems like a short-term solution before returning to broader licensing strategies. 2) Streamers swoop in to secure even more sports rights deals, smelling blood in the water and potentially shifting the entire landscape long term. 3) Linear networks double down to invest even more money on rights, partly to offset any domination play by aggressive Silicon Valley streamers looking to shore up their subscriber bases. 4) Big broadcasters throw a Hail Mary pass to bring more rights back to local stations, especially through individual deals with sports teams eager to tap into local fanbases. We explore these scenarios and more and reveal other proprietary data around sports rights in our new report. It’s truly a sports multiverse, although various levels of madness may still be up for grabs.