Cord cutting, the streaming wars, content cost inflation, and advertising pressure continue to swirl under the weight of Wall Street stock declines that have put everyone in a bad mood. It’s not the kind of environment that typically lures rich retirees back into the stress-inducing pressure cooker of the modern content business. But on Sunday night, Disney’s board somehow convinced former CEO Bob Iger to come out of his short-lived retirement for at least another two years. It was a stunning development, and one that left many scratching their heads. Why would Disney’s board extend CEO Bob Chapek’s contract for three years only to oust him five months later? That’s a lot of severance to pay out, after all.

But alas, Disney under Chapek has not been the happiest place on Earth, and the company’s massive $1.5 billion loss on its direct-to-consumer business disclosed early this month during its fiscal Q4 earnings report might have simply been the straw that broke Mickey’s back.

Interestingly, the new Bob (who is, quite literally, same as the old Bob) on Monday started the process of “re-Igering” Disney, immediately showing Chapek’s chief lieutenant Kareem Daniel the door on Day One. Daniel, of course, headed all content distribution under Chapek to the reported dismay of once independent Disney creative fiefdoms that under Iger had enjoyed wide latitude to develop and distribute their own shows and movies. Chapek changed all that, putting everything under Daniel’s thumb. Now, the new Bob has started to at least partially reverse course, telling staff in a Monday morning memo to expect a “new structure that puts more decision-making back in the hands of our creative teams and rationalizes costs.” This “new” structure will likely mirror Iger’s old structure before he ceded the CEO reins to Chapek, but let’s see exactly what his top creative execs propose. This is a new day. Like the old days. But perhaps it feels like the good old days. Or a newly hazy daze. Or something.

Of course, all this drama involving mega-rich executives is entertaining but hardly the point. Iger faces the same headwinds that Chapek would have continued to face as CEO, although Iger will likely brave those winds with a warmer smile. To be sure, these kind of shifts are always an opportunity, and Iger’s two-year contract might be just enough time to pull off something big. This is the guy who literally turned Disney from a fading also-ran into the gargantuan media giant that stands before us in 2022, having snapped up Pixar and then Marvel and then Lucasfilms (Star Wars) and then most of 21st Century Fox’s assets (although some believe he overpaid for Fox). Bob Iger built Disney as we know it today. And now he’s back for two years, which is plenty of time to right the ship. But it’s also enough time to do some bold dealmaking. And we wonder. Is Disney the Apple of somebody’s eye? Hmmmm…

Next? We’ll admit this is wild speculation. It’s very possible that Disney brought Iger back simply to boost sagging executive morale, bring costs under control, and return some sanity to the DTC business. Iger certainly will have his hands full launching the Disney+ ad-supported tier next month. But it’s also possible that amid the day-to-day challenges he’ll start making longer term strategic moves to fully cement his legacy, including perhaps one last megadeal. Recall that Apple has reportedly been sniffing around Disney since the company’s stock decline began a few months ago. While it’s hard to imagine antitrust regulators blessing a merger of the largest company on the planet with the most influential studio in Hollywood, the two companies don’t compete in many areas other than streaming. Even there, Apple TV+ pales next to Disney’s vast library. But this would be the kind of deal that feels too massive for anyone worried about media and technology consolidation. Combining Apple TV+, Hulu, Disney+, ESPN, iPhones, Macs, and more into one sprawling global monstrosity is likely to raise serious antitrust concerns. But there’s one improbable but possible scenario that – if all the pieces came together under perfectly aligned stars – could make an Apple-Disney marriage a reality.

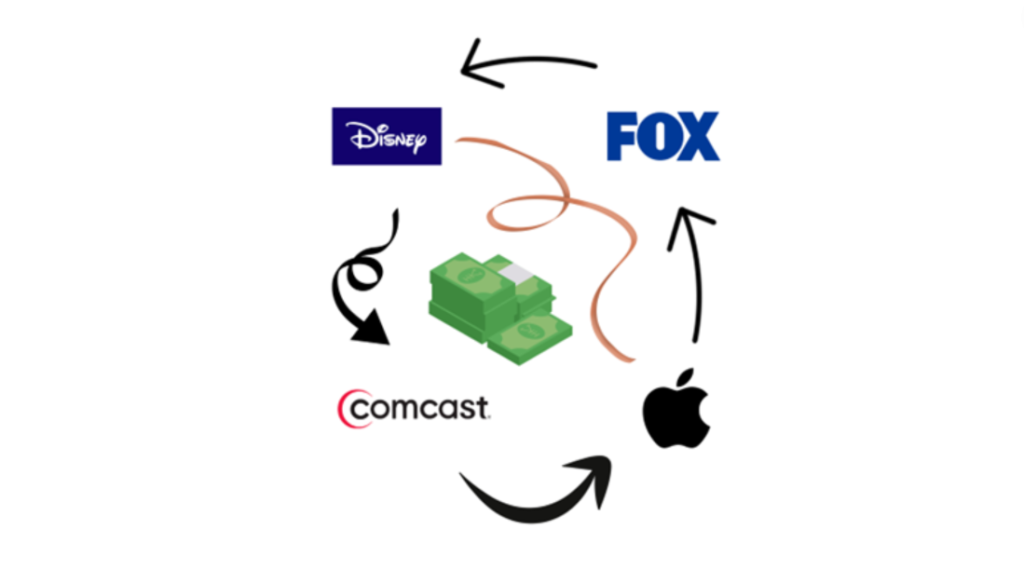

Comcast CEO Brian Roberts recently expressed interest in buying all of Hulu. So why not let him? Rather than buy back Comcast’s one-third Hulu stake next year, Iger could sell Comcast’s NBCUniversal the other two thirds for a $20-plus billion payday. Disney could also offload control of cord-cutting challenged ESPN to Fox Corp., whose live sports focus would make it a good suitor assuming it could somehow cobble together the billions required amid an environment of rising interest rates. This could potentially satisfy regulators. Apple, which has its own Hulu in Apple TV+ and has yet to build out a big sports slate (although it will launch MLS in February), would acquire valuable, family-friendly IP, not to mention theme parks and resorts that could further showcase Apple’s hardware and software. A staged or simultaneous transaction could instantly lighten Disney’s load in streaming and sports while still satisfying regulators and creating the biggest content, software, and hardware juggernaut the world has ever seen. Hulu and ESPN are great assets, but they might be worthy sacrifices for the greater Apple-Disney good.

Could all of these pieces really fall into place within two years? Probably not, but it’s the kind of complicated, near impossible feat that, if successful, would cement Bob Iger’s legacy as the greatest media executive in the history of the world. What better time to swing for the fences than the current environment of cheaper media valuations and overall industry chaos? Disney would of course be fine on its own without Apple. But what a pairing of leading tech and content. And if anyone could pull something like this off, it’s Bob Iger.