Netflix this week finally pulled back the curtain on its previously announced plans to launch an ad-supported tier, and the details suggest that the streamer has opted to move fast. No dancing around the edges to iron out kinks and build the business slowly. First of all, Netflix has opted to get aggressive on price, charging $6.99/mo and at the lowest possible range of the $7-9/mo that earlier reports suggested it was considering. Making the ad tier cheap means high-end SVOD customers can cut their monthly bills by a hefty 65% if they’re willing to watch ads. But there’s a catch: the “Basic with Ads” tier will cap resolution at 720p, limit streams to one person vs. two and four for its Standard and Premium SVOD, respectively, and may offer less content (some Netflix shows aren’t ready for ad insertion).

Those factors may hold down the number of existing customers downgrading, but Netflix is also trying to grab new customers. So, its $6.99/mo pricing – a full dollar below the $7.99/mo Disney+ plans to charge for its own ad-supported tier launching a month later on December 8 – gives Netflix a few weeks to snap up the lowest hanging fruit before Disney+ enters the arena.

It may not seem like much, but with consumers worried about gas prices, inflation, and rising interest rates, those extra few weeks might turn out to be more significant than they would have been before the economy started to teeter. Throw in other reports this week that Apple TV+ might even launch an ad tier in early 2023, most likely to support its burgeoning live sports ambitions, and wow… this space is getting hot, hot, hot.

Interestingly, Netflix isn’t limiting its initial launch to the U.S. Rather, it’s launching in 12 countries, with Canada and Mexico going first on November 1, and the U.S. and the remaining countries joining on Nov. 3. Why Netflix is launching two days early in Canada and Mexico is anyone’s guess, but the relatively simultaneous launch across many regions suggests that Netflix is confident in the ad tech stemming from its partnership with Microsoft announced in July. As the Wall Street chattering classes speculate that Microsoft could purchase Netflix outright at some point (especially with the streamer’s stock so depressed), the more likely scenario is an increasingly intertwined relationship between the two companies, starting with advertising and quickly accelerating on the gaming side, an area Netflix has identified as a growth engine and that Microsoft’s pending Activision Blizzard acquisition set to close in mid-2023 could greatly enhance. The developing dance between Redmond and Los Gatos as these two companies deepen their relationship will be something to watch, especially if their two cultures seem to still get along a few months from now.

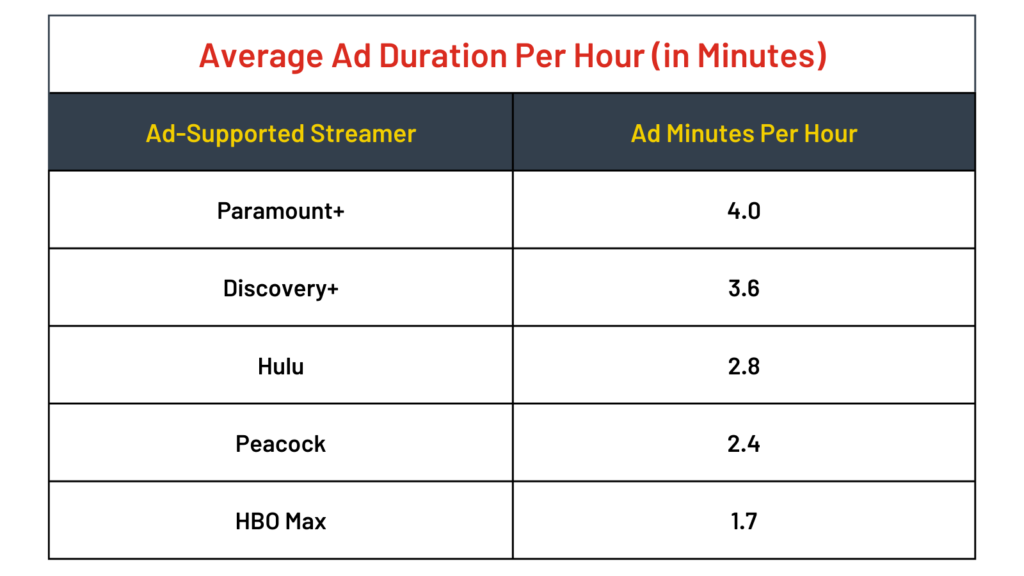

Also intriguing is how Netflix is limiting the breadth of advertising to preserve what it can of the user experience. As previously reported, the streamer has said it will limit advertisers to $20 million in annual spending to ensure that consumers don’t see the same brands or ads over and over again. But this week it also confirmed that it will limit ads to 4-5 minutes per hour, which puts it on the higher end of its ad-supported peers in terms of how some of its major streaming competitors averaged out over the first three quarters of 2022, according to our ADTRAKER® intelligence service. As of September, only Paramount+ was averaging as high as 4 minutes of ads per hour, with Hulu, HBO Max, Peacock, discovery+, and others falling well below that level. Netflix is also playing it safe in terms of format, offering standard 15- and 30-second spots and including pre-roll ads (Movies will only have pre-rolls to minimize disruption while TV shows will show ads throughout.) And a short-term problem is that much of Netflix’s content can’t serve up ads at launch because of licensing issues. That will work itself out over time though, and perhaps faster than we expect: Netflix ad chief Jeremi Gorman said this week that Netflix has nearly sold out its inventory pre-launch, with “hundreds” of advertisers signed up.

Next? This is only the beginning for Netflix as it crawls back from a couple of brutal quarters amid a challenging Wall Street environment for all media companies, including most of its biggest competitors. Things are tough all around. And as we’ve noted before, it’s unclear whether Netflix will sign up enough new ad-tier subscribers to make up for the ones that downgrade from the more expensive SVOD tiers, especially now that Netflix has settled on a bargain basement price for its new ad-supported tier. Netflix COO Greg Peters told reporters this week that “from a revenue perspective, he expects a “neutral to positive” result. So Netflix certainly doesn’t expect to end up in negative territory, but neutral-to-positive doesn’t sound like the company’s banking on a multi-billion dollar net windfall either. Then again, Netflix might be trying to keep expectations low so it can exceed them (as it did with its Q2 subscriber losses that beat its own forecast). With rumors afoot that Netflix also will largely abandon its famous “binge” model of releasing most seasons all at once, these are interesting times for the streamer and its investors. Netflix has always bested naysayers in the end. And with apologies to “Star Trek” owner Paramount Global, the ad tier is not Netflix’s Final Frontier. As it tests new content strategies and even integrates gaming with Microsoft’s help, this is really only the beginning. And it will boldly go…