In the first five months of 2022, Peacock, The Roku Channel, and Tubi all served an average of over four pods each hour on FAST channels compared to about two and a half pods per hour on on-demand. Similarly, the hourly ad duration on FAST channels at these providers tended to outpace that seen on on-demand. Peacock provided 4.8 minutes of filled advertising time each hour on its FAST feeds versus 2.1 minutes of advertising for VOD titles, for example. That gap is notable on Peacock, which tends to present some of its “live” channels as pre-formed playlists of what amounts to VOD content. For Pluto TV and Xumo, it’s a different story.

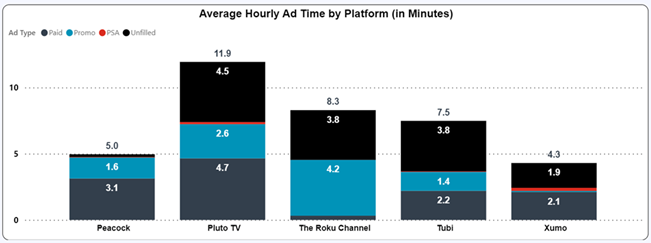

Pluto AVOD presented an average of over 10 minutes of advertising per hour compared to just under 7.5 minutes of filled advertising observed on Pluto FAST. Xumo AVOD presented about a minute more advertising per hour at 3.2 minutes versus 2.4 on FAST. When including unfilled advertising inventory, however, the delta in advertising observed on FAST and VOD playback reverses, with more time allocated to the live streams than observed on VOD.

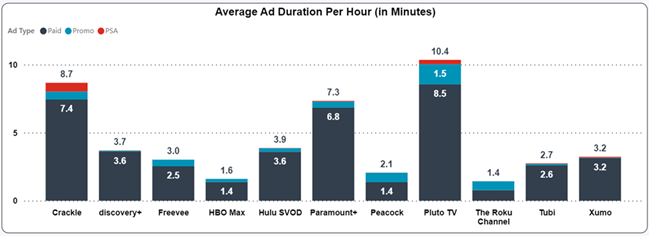

AVOD Average Hourly Ad Time (Jan - May 2022):

FAST Average Hourly Ad Time (Jan - May 2022):

Next? The majority of AVOD services with FAST channels audited for ADTRAKER are holding to the strategy seen on traditional platforms where linear TV has typically seen more frequent ad breaks and longer ad durations. That said, there isn’t a clear consensus. New, forthcoming modes of advertising such as Peacock’s “Frame Ads” and “In-Scene Ads” point to alternatives that may contribute to lower ad loads on sponsored on-demand content or else expand ad loads on FAST while maintaining a continuous stream of live content like news or sports. The ad experience at Pluto may foreshadow uniformity down the line regardless of playback type. With more people tuning in to watch ad-supported streaming video than ever before, and entrants from Disney+ and Netflix expected later this year, it’s likely there will be plenty of experimentation before a dominant paradigm for the category emerges, especially as more providers look to incorporate live programming.