T-Mobile executives reveled in the success of their fixed wireless access product on the carrier’s Q4 2021 earnings call on Feb. 2, with CEO Mike Sievert describing the service as “mainstream” due to the subscriber uptake.

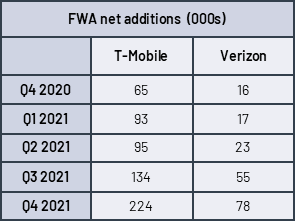

Impact: T-Mobile ended 2021 with 646,000 fixed wireless access subscribers, including 224,000 added in Q4 and 546,000 for the year. With most of T-Mobile’s FWA subscribers coming from urban and suburban environments, Sievert said the service is “ready for its prime time moment.” T-Mobile has priced its FWA service at $50/mo for existing customers with no additional fees, and has set it sights on stealing wireline broadband subscribers from its larger cable competitors.

T-Mobile VP Dow Draper asserted that the majority of T-Mobile’s FWA customers added in 2021 came from cable and fiber, pointing out T-Mobile’s affordability versus a cable wireline subscription especially when fees and additional charges are added into the mix. Comcast executives, for their part, have yet to blame lower broadband subscriber growth on increased competition from either fiber buildouts or FWA activity within its footprint. And up until now, Wall Street analysts have been skeptical of T-Mobile’s ability to snag customers away from cable and other incumbent wireline providers due to concerns about network capacity limits.

But that stance may change sooner rather than later.

A new Bloomberg report showed that 22% of 3.7 million new broadband customers in 2021 were subscribed to a fixed wireless product. According to Sievert, T-Mobile’s FWA customers average 300-400 GB of data each month, but some gobble up as much as a terabyte, which he says the company’s network is handling comfortably.

T-Mobile plans to build on its existing 5G lead in 2022 even as AT&T and Verizon race to add mid-band spectrum into their own networks. According to technology head Neville Ray, T-Mobile will push its Ultra Capacity 5G coverage, which runs primarily on 2.5 GHz mid-band spectrum, up to 260 million people by the end of this year and to 300 million by the end of 2023. T-Mobile also has other mid-band spectrum to add into its network, including lesser amounts of C-band than its two primary competitors and the 3.45 GHz spectrum it recently acquired in FCC Auction 110.

AT&T also holds a substantial amount of spectrum in both of those bands (40 MHz each for C-band and the 3.45 GHz band) and plans to start deploying it in a “one climb” strategy as soon as mid-year 2022. T-Mobile outlined a similar strategy for its deployment of the additional mid-band spectrum, which it plans to use to densify its network in the urban and suburban areas where FWA is taking off. But T-Mobile’s “one and done” plan won’t begin until next year because it’s waiting on production of a single radio that will support both bands, whereas AT&T will install two radios integrated together during its own deployment.

In other wireless metrics, T-Mobile reported close to 1.8 million net postpaid additions in Q4, up 8.2% year-over-year. That included 844,000 net postpaid phone additions, also above the 824,000 adding in the same quarter a year ago. For the full year, T-Mobile added 5.5 million postpaid customers, including 2.9 million postpaid phone customers. Full-year postpaid customers were up 0.2% from 2020, while full-year postpaid phone customers increased 31.5% YOY.

Without explicitly saying so, T-Mobile has outlined twin goals for its business: maintain and even expand upon the 5G lead it has built over wireless competitors AT&T and Verizon while also taking wireline broadband subscribers from cable operators. Those two goals don’t necessarily seem aligned at first glance, but they seem to converge in T-Mobile’s FWA product — stealing wireline subscribers from cable requires a strong 5G network with the capacity to service both fixed wireless and mobile subscribers. And continuing to strengthen its 5G network will make it hard for either of its two primary competitors to catch up in mobile 5G.