Anyone expecting a third quarter turnaround in Verizon’s mobile fortunes likely wasn’t happy with CEO Hans Vestberg’s recent admission that the carrier expects to lose phone customers again in Q3.

Impact: For those counting, that means Verizon will have lost wireless retail postpaid phone customers in all three quarters so far in 2022 after losing 292,000 subscribers in Q1 and another 215,000 in Q2. A third straight quarter of consumer mobile phone subscriber losses, which is a first for the company, won’t help Vestberg’s fortunes as the CEO appears increasingly embattled as he tries to turn things around. While Verizon has had significant success with its 5G-powered fixed wireless access service as an alternative to traditional wireline broadband and now claims 700,000 5G FWA customers across both consumer and business, the mobile side of Verizon’s wireless house has struggled mightily of late at a time when rivals AT&T and T-Mobile have been able to post significant postpaid subscriber gains.

On the plus side, Vestberg said the mobile losses would lessen in the third quarter, with a chance the company could get back to positive growth with its Q4 results. Vestberg continues to stand by what he called the company’s “turnaround strategy” and touted Verizon’s position in the market, its ability to compete, the ongoing C-band deployment (Verizon has more of the coveted 5G spectrum than anyone), and the launch of new mobile plan options as ways it will win back customers and hold onto the loyalties of existing subscribers.

For instance, in areas where Verizon has already deployed C-band spectrum, Vestberg says the company is seeing a “much higher step-up ratio in those markets,” as customers shift to more expensive unlimited plans to access the faster speeds associated with Verizon’s 5G plans. The expectation is that this will help Verizon drive more revenue growth.

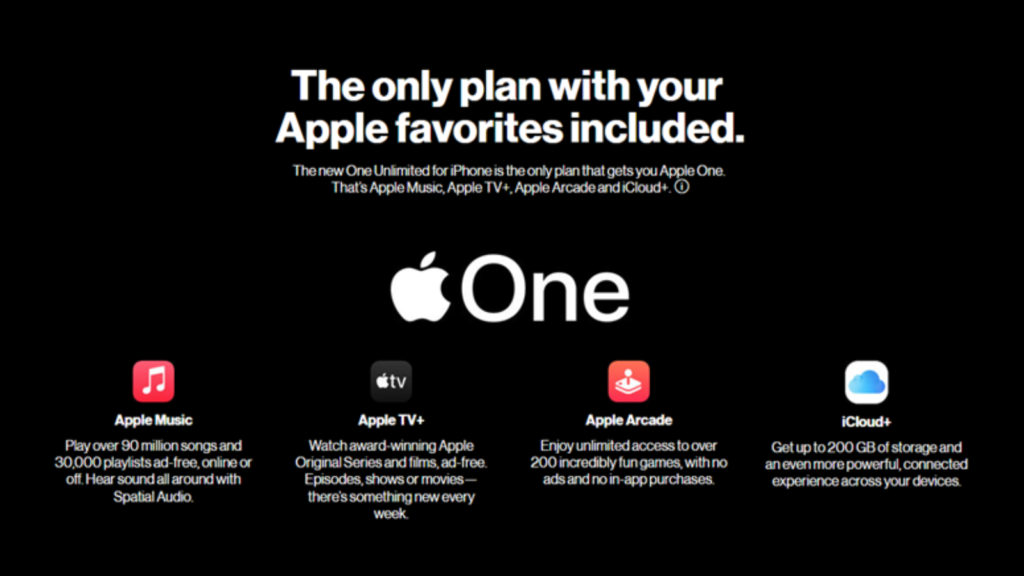

As for those new mobile plans, Vestberg has high hopes for the success of both Verizon’s relatively new Welcome Unlimited offering and its more recent Verizon One Unlimited for iPhone premium plan. While the Welcome Unlimited option targets entry-level customers and those new to Verizon with a $65/mo price point, the $90/mo One Unlimited plan aims to retain and attract customers looking for a more premium plan option, complete with the bells and whistles of the Apple One service. Both are part of what Vestberg described as Verizon’s strategy to address each market segment individually in order to give customers the best options for service. While that plan may be working – Vestberg said Verizon is seeing more traffic in its retail stores – any improvement likely won’t be fully reflected in the Q3 results. The hope is that eventually both plans will help Verizon reduce its churn, which increased over the summer after price increases to some existing plans.

Whether Vestberg’s commitment to the company’s extensive 5G buildout and “turnaround” strategy pays off remains to be seen, but if Verizon keeps losing mobile subscribers any turnaround could come too late to save his job.