Despite an accelerated buildout schedule and subscriber gains on the fiber side, Altice USA’s overall broadband subscriber numbers trended negative again in the first quarter.

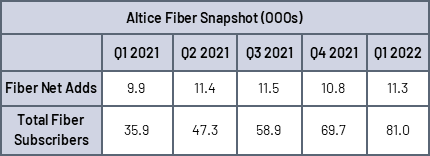

Impact: Altice added 145,700 new fiber passings in Q1, which pushed its total fiber locations past the 1.3 million mark. Edge-out locations also grew, by 42,000, and Altice reported adding 273,000 edge-out locations in the past 12 months as it aims to add a total of 175,000 in 2022. The additional coverage increased Altice’s fiber subscriber base to 81,000 on the strength of 11,300 fiber net additions, an increase of 14% year-over-year. These fiber numbers are combined residential and business subscribers, but residential makes up 99.3% of Altice’s fiber subscriber base at this time, including 98.2% of the gains in the first quarter.

However, these numbers were dampened by Altice’s overall broadband subscriber numbers, with the company reporting a loss of 13,000 broadband subscribers in the quarter compared to last year’s first quarter when it gained 11,500 broadband customers. CEO Dexter Goei attributed the third consecutive quarter of broadband subscriber losses to lower move activity. Both Comcast and Charter have also seen broadband subscriber growth slow since the second half of 2021, and both have also attributed the issue at various times to low churn, low move activity, and low household growth. The difference is that the two larger cable operators have managed to stay on the positive side of the ledger. Altice, on the other hand, is spending capital to build out fiber while losing broadband subscribers, a pattern AT&T is also following at the moment.

While Goei didn’t exactly project confidence that Altice would be able to overcome the broadband deficit in 2022, he did predict that broadband subscriber growth will shift back into positive territory in the second half of the year as more fiber locations come online. But he wasn’t willing to forecast whether full year broadband subscriber growth would fully rebound. With Altice planning to roll out multi-gigabit fiber Internet service in the second quarter, it may be able to pull in some heavy data users in areas of its footprint where Altice’s direct competitors don’t offer that kind of speed option. There’s also optimism that bringing Suddenlink under the Optimum brand and the new marketing campaigns that will accompany that effort help with subscriber growth.

Goei remains positive about Altice’s competitive position thanks to the company’s ongoing fiber build, which calls for covering 6.5 million locations with fiber by the end of 2025. This confidence comes despite increased competition from other fiber players and their multi-gigabit offerings, including AT&T in Altice’s Suddenlink markets and Frontier in Connecticut. Not to mention that the question of whether fixed wireless expansion efforts could negatively impact Altice’s fiber goals remains. But if its fiber buildout proceeds as planned, Altice will have multi-gigabit Internet service available to two-thirds of its footprint within four years, which the company views as a good spot to be in. Altice has already started migrating customers off of hybrid fiber/coax and onto fiber in areas where fiber is available and eventually will only offer fiber in those locations. A with slightly less than half of Altice’s customers taking gigabit Internet service and a fiber penetration rate of 17%, Goei still sees room to grow with gigabit and multi-gigabit fiber offerings.