On Comcast’s Q1 earnings call, company executives revealed more detail about a plan to grow the cable provider’s footprint by at least 800K new broadband passings in 2022.

Impact: The strategy focuses on edge-out opportunities — areas adjacent to Comcast’s existing footprint — as a way to combat an ongoing slowdown in broadband subscriber growth. Company executives attributed much of the slowdown to lower move activity, the same issue Comcast dealt with in the second half of 2021. While Comcast will also look at expansion opportunities within its traditional cable footprint, most of the focus will be on edge outs. According to Cable CEO Dave Watson, Comcast has been busy identifying and applying for funding that would support its edge-out plans in rural areas and make them more economical to pursue.

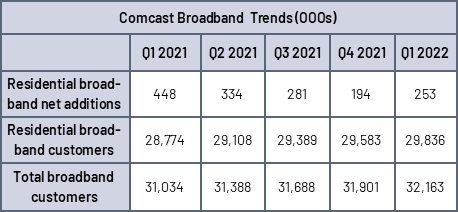

Although Comcast beat broadband subscriber expectations in Q1 with the addition of 262,000 broadband subscribers, the gains were 43.2% lower year-over-year than 461,000 net additions in last year’s pandemic-fueled first quarter. Residential net additions comprised the bulk of those gains at 253,000 in the quarter, 43.5% less than last year’s 461,000. In addition to the impact of lower move activity on broadband subscriber growth, Watson for the first time acknowledged the increased competition Comcast faces from fiber buildouts and fixed wireless deployments. But even so, he maintained that Comcast is holding its own in the market, referencing record low quarterly churn (Comcast does not release churn numbers). He also cited mobile as an advantage for Comcast in the market, especially with bundle offers that tie broadband and mobile service together, after the company added 318,000 new mobile subscribers in the quarter.

However, Wall Street analysts were not as high on Comcast’s gains, with some quickly pointing out that approximately one-third of Comcast’s new quarterly additions appeared to stem from the conversion of customers on free pandemic-era plans to regular plans as paying subscribers. Without that help, analysts calculated that Comcast’s net additions would have been in the 170,00-180,000 range, under expectations that averaged around 214,000.

New technology, including the hollow-core fiber Comcast trialed in April, and the cable industry’s 10G initiative should also help Comcast reverse the broadband subscriber slowdown, especially after a recent 10G test using DOCSIS 4.0 on a live network yielded speeds of 8.5 Gbps downstream and 6 Gbps upstream. The ability to counter fiber with symmetrical multi-gigabit speeds will be critical to cable’s ability to counter the wireline speeds fiber operators can offer. But a new broadband report from Kagan says that with total high-speed Internet penetration of more than 90% in the U.S., the battle for subscriber growth will become a fight for market share among cable, telecom, and satellite providers. Kagan estimates total U.S. broadband subscribers will hit 122 million at the end of this year, meaning in the future one competitor’s subscriber growth will be another’s loss as the ability to grow organically by adding customers new to broadband becomes more difficult.