The fiber buildout craze sweeping the country also extends to smaller regional players like Virginia-based Shentel, which has been implementing its own fiber deployment strategy under the Glo Fiber brand name across a four-state footprint.

Impact: Shentel’s Glo Fiber service is currently active in 12 markets across Maryland, Pennsylvania, Virginia, and West Virginia, including eight markets added in 2021 which increased Shentel’s fiber route miles 8.8% year-over-year to nearly 7,400. As a result of those deployment efforts, Shentel added 46,000 new fiber passings in 2021, expanding its total number of Glo Fiber locations to 75,000 at the end of year. This propelled an increase in Shentel’s Glo Fiber subscriber base to 11,377, nearly tripling its fiber customers in a year from the 4,158 it reported at year-end 2020. Shentel also revealed a fiber penetration rate of 15.1%

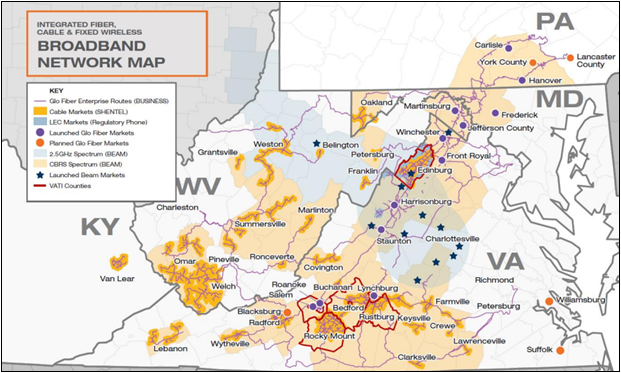

Shentel plans to build on that progress, setting a goal of adding another 75,000 fiber passings in 2022 to double its total fiber footprint to 150,000 by the end of the year. That buildout will then increase to 100,000 new fiber passings in 2023 as Shentel works toward its ultimate goal of 450,000 locations passed with Glo Fiber by year-end 2026. In fact, Shentel already has five additional Glo Fiber deployments underway with launch dates planned in 2022: Blacksburg, Suffolk, and Williamsburg, VA, and Lancaster and York counties in Pennsylvania. In March 2022, Shentel announced Salisbury, MD as its second Glo Fiber market in Maryland, with construction scheduled to start in early 2023. Markets where Glo Fiber is currently available include Frederick, MD; Carlisle and Hanover, PA; Front Royal, Harrisonburg, Lynchburg, Roanoke, Salem, Staunton, and Winchester, VA; and Martinsburg and Jefferson County, WV. Though most of its Glo Fiber focus has been on Virginia thus far, Shentel is gradually extending fiber out into other areas of its footprint.

Shentel also has a fixed wireless offering known as Beam, but put growth of that product on hold in 2021 to accelerate its shift to a fiber-first focus. Prior to the pause, however, Shentel had expanded Beam to more than 18,000 locations passed in nine Virginia markets and grew its fixed wireless subscriber base by 93.3% YOY (1,376 new subscribers) to 1,475 in 2021 with a 5.3% penetration rate in markets where Beam has launched. Although Shentel was making progress with Beam at the time of the pause, the fiber growth rate was so much better that company officials decided to go all-in on fiber instead. Whether Shentel will circle back to its Beam buildout in the future as nationwide FWA growth accelerates seems unlikely at this time. But that will likely depend on well the Glo Fiber buildout proceeds.