Although CEO John Stankey reported during the Q1 earnings call that fiber makes up nearly half of AT&T’s consumer broadband revenue, gains in fiber were not enough to offset the losses from non-fiber broadband and legacy DSL service.

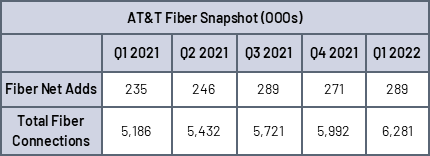

Impact: AT&T added 289,000 fiber Internet customers in the first quarter, elevating its fiber subscriber count to 6.3 million of its 13.8 million total broadband connections. But AT&T also lost 284,000 non-fiber consumer broadband subscribers, a total that did not include its legacy DSL numbers. So what at first glance seemed like a gain of 5,000 overall consumer broadband subscribers trended negative once DSL losses were factored in, for an overall loss of 12,000 consumer broadband customers.

AT&T appears to be differentiating between broadband and DSL, with fiber and non-fiber categories under the broadband banner, as an attempt to puff up its broadband numbers without the impact of legacy DSL losses. It’s no surprise then that AT&T touted its strong Q1 fiber growth during the earnings. Those 289,000 new fiber customers in the quarter helped push AT&T’s market penetration rate in fiber locations to 37% and spurred fiber revenue growth by nearly 25%. Total fiber coverage increased to 17 million customer locations after AT&T deployed coverage to 800K additional locations during the quarter. AT&T continues to light up multi-gigabit service to more of those locations, which Stankey said was contributing to some of the fiber momentum. But Stankey declined to reveal what AT&T’s subscriber numbers look like for the multi-gigabit service.

To further muddle the overall broadband numbers, AT&T doesn’t differentiate between consumer and business fiber subscribers, and in fact classifies them under its Consumer Wireline category. But it seems likely that at least some of its fiber subscriber gains and additional fiber locations come from the business side since AT&T offers a business version of its multi-gigabit fiber service right on its website.

Because the quarter was AT&T’s last as a player in the entertainment industry following the closure of its spin-off of WarnerMedia to Discovery, it’s now free to focus on its core business segments, which include fiber and 5G wireless. Per Stankey, the deal’s closure means “AT&T has entered a new era, meeting this opportunistic moment from a position of flexibility and strength thanks to our evolving networks.” He specifically called out growth in the 5G and fiber customer base as a sign AT&T is making progress on its goal to become what he called “America’s best broadband provider.”

But until AT&T can consistently overcome the combination of non-fiber broadband and DSL losses, it’s going to be spending a lot of capital on a fiber deployment strategy – and projected increased fiber gains – that isn’t enough to overcome subscriber losses elsewhere. Combined with the ongoing decline in AT&T’s business wireline revenue and its third-place spot in the 5G rankings, Stankey and company have their work cut out for them if they want to achieve success in these core segments and will need to capture more customers seeking “best-in-class connectivity solutions.”