Frontier continues its march toward 10 million fiber locations by year-end 2025, finishing the year at sixty-five percent of the way to that goal after adding more than 1.3 million passings for the full year in 2023.

Impact: Frontier reported another strong quarter related to its fiber product in Q4, which led to full-year EBITDA growth for the first time in more than a decade as fiber-related EBITDA increased 14%. Although total revenue decreased a marginal 0.6% year-over-year in 2023 to $5.75 billion, fiber revenue increased 8.2% to nearly $3 billion and residential fiber revenue increased 11% for the year. CEO Nick Jeffery hailed what he called a return to “sustainable growth” and expressed confidence Frontier’s growth would continue to accelerate in 2024 as it increases fiber penetration rates and fiber ARPU. The company plans to achieve 45% penetration across its fiber footprint, but Jeffery predicted that number could end up higher. Frontier reported 30.9% fiber broadband penetration across its various cohorts at the end of the year, down from 32.6% in 2022. Fourth quarter consumer fiber broadband ARPU came in at $64.16, up 4.8% compared to $61.20 in Q4 2022. Full-year ARPU increased 1.5% YOY to $63.39.

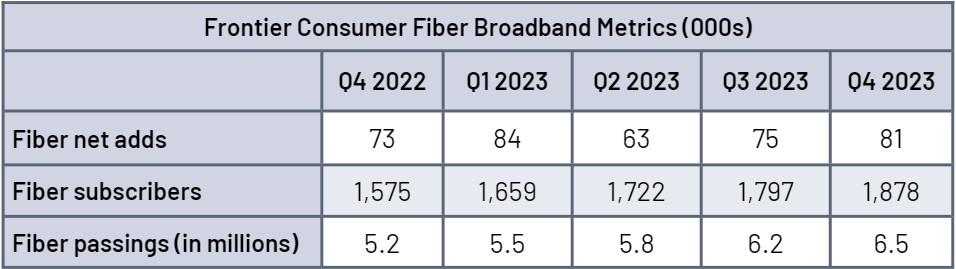

Frontier added 333,000 new passings in Q4, increasing total fiber locations to 6.5 million, and plans to add at least another 1.3 million locations in 2024. The fourth quarter passings basically matched the number of new passings Frontier added in Q3, although that figure fell 12.6% from the number of passings the company added the previous Q4. The buildout pace lifted total fiber passings 25% higher than they had been at the end of 2022 – 6.5 million compared to 5.2 million. Frontier claims to have doubled its fiber footprint since 2020 when calculating number of passings from year-end 2020 to year-end 2023. Of course, that timeframe includes five months while the company remained under bankruptcy protection before emerging with a new management team in May 2021.

As for subscribers, Frontier added 81,000 residential fiber broadband customers in the quarter, up 8% sequentially and 11% year-over-year. For the full year, Frontier added 303,000 new residential fiber broadband subscribers, 26.8% more than it added in 2022. Overall the company added 84,000 and 318,000 total fiber subscribers in Q4 and 2023, respectively, with the full-year total a new quarterly record for fiber net adds. Frontier’s residential fiber broadband base increased 19.2% to nearly 1.9 million in Q4 and total fiber broadband grew 18.8% to 2 million. Frontier also claims to have increased fiber broadband customers by 50% since 2020, again when calculating from the end of 2020 to the end of last year.

Like nearly all of its telecom brethren, Frontier continues to see degradation in its legacy copper subscriber base, reporting a net loss of 48,000 legacy consumer subscribers in Q4, although that number improved both sequentially and YOY. For the full year, Frontier lost 221,000 legacy residential broadband customers, 15% more than it lost in 2022. Frontier ended 2023 with a base of 822,000 legacy residential broadband customers. When combined with the fiber gains, total residential broadband nets adds came in at 33,000 in Q4, triple its total net adds in the same quarter last year. For the full year, residential broadband net adds numbered 82,000, an increase of 70.8%, increasing Frontier’s total residential broadband base to 2.7 million.

The strength of Frontier’s fiber metrics have helped the company solidify its claim that it’s the largest pure-play fiber Internet company in the country. Its significant progress as a fiber player in a short amount of time has seemingly made it an attractive acquisition target, if attempts by activist investor Jana Partners to get Frontier to sell itself are any indication. Jeffery acknowledged the company’s ongoing strategic review on the Q4 earnings call, noting the company has numerous options under consideration to deliver more value to its shareholders. While it contemplates its next move, Jeffery plans to keep Frontier on its current course of fiber and more fiber.