According to CEO John Stankey, AT&T had already signed up its first Gigapower customer ahead of the company’s April Q1 earnings call and before the deal to establish the open-access fiber joint venture with BlackRock Alternatives has closed.

Impact: Not only has AT&T gotten its Gigapower deployment off to a fast start, FierceTelecom recently found evidence AT&T seems to have its eye on additional markets in Arizona and Nevada. These new markets, which include the Phoenix suburbs of Chandler and Gilbert as well as Las Vegas, would build on the company’s first project in Mesa, AZ, presumably home to the first Gigapower customer.

These new markets, which include the Phoenix suburbs of Chandler and Gilbert as well as Las Vegas, would build on the company’s first project in Mesa, AZ, presumably home to the first Gigapower customer. AT&T has signed agreements with all three cities, per Fierce, including license agreements with Chandler and Gilbert and a non-exclusive franchise agreement with Las Vegas. Given Google Fiber’s reported interest in expanding into Las Vegas and Nevada at large, the non-exclusive deal with Gigapower is no surprise. While Stankey was mum on the location of the first live Gigapower customer, he said AT&T is “the first seller of product on that infrastructure.”

For a company that didn’t have a wireline broadband presence in Arizona before announcing last summer that it planned to make Mesa its first out-of-footprint fiber expansion market, AT&T has taken a significant interest in the state. It’s a surprising turn of events, considering all of the fiber overbuilder competition there as well as two incumbents in Lumen and Cox that are both working on their own network upgrades. Mesa currently has at least six providers working to deploy fiber there and now several of those will also compete with each other in Chandler (AT&T and Google Fiber, for starters) and Gilbert (AT&T and Wyyerd Fiber so far), with Lumen likely plotting its own Quantum Fiber expansion efforts in both areas as part of its overall Phoenix expansion and Cox undertaking its own significant fiber-based upgrades across its footprint. AT&T and Google Fiber could also find themselves competing against each other in Las Vegas when and if Google Fiber pulls the trigger on a deal there, and facing off against the same two incumbents they’ll go up against in Arizona. Las Vegas would be the big crown in this competition, given that it’s home to at least 645,000 households compared to approximately 100,000 in Chandler and 88,000 in Gilbert according to U.S. Census Bureau data cited by FierceTelecom.

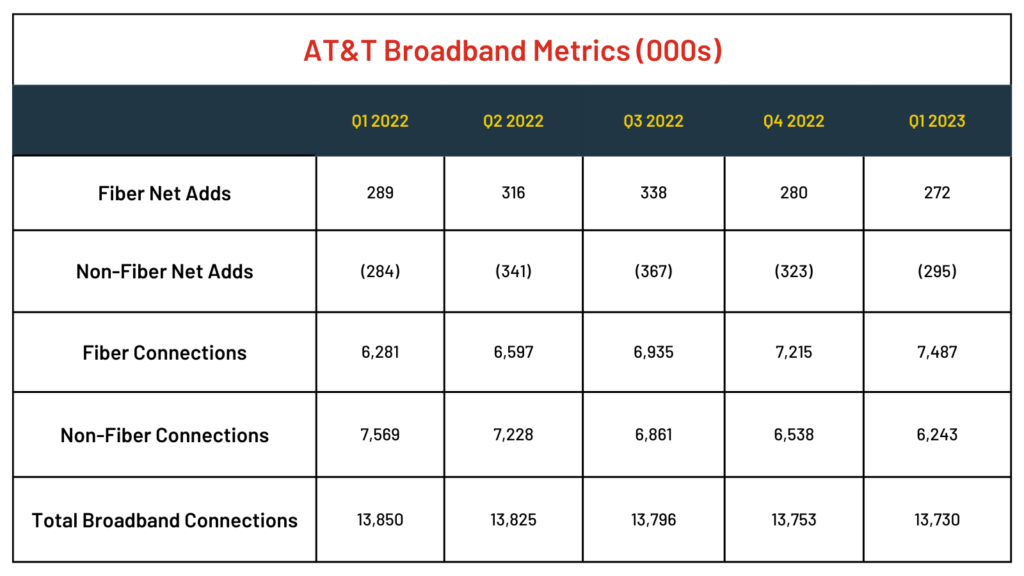

After a network update in March revealed AT&T’s fiber coverage had increased to 24 million locations, including 4 million on the business side, AT&T reported 600,000 new fiber passings in Q1 to push its total consumer fiber locations to 19.7 million. Stankey said AT&T remains on target to hit its goal of reaching 30 million locations with fiber by year-end 2025, a number that supposedly will not include the company’s planned 1.5 million Gigapower passings. But after hitting 1 million new passings in Q2 2022, the company’s buildout pace has tapered out significantly in the past several quarters, hovering around 500,000-600,000 since Q3 last year. AT&T reported 272,000 consumer fiber net additions in the quarter, marking the 13th consecutive quarter of fiber net ads of more than 200,000. That number was down 2.9% sequentially and 5.9% year-over-

year, however, and the fiber gains weren’t enough to overcome 295,000 non-fiber losses, a number that doesn’t even include AT&T’s DSL numbers. Stankey blamed the lower net adds on lower move activity, echoing statements we’ve heard from cable executives for a year or more as the pace of their broadband net additions has slowed considerably. It appears that if AT&T’s fiber grow slows, Gigapower could help pick up the slack.

Share on facebook

Facebook

Share on twitter

Twitter

Share on linkedin

LinkedIn