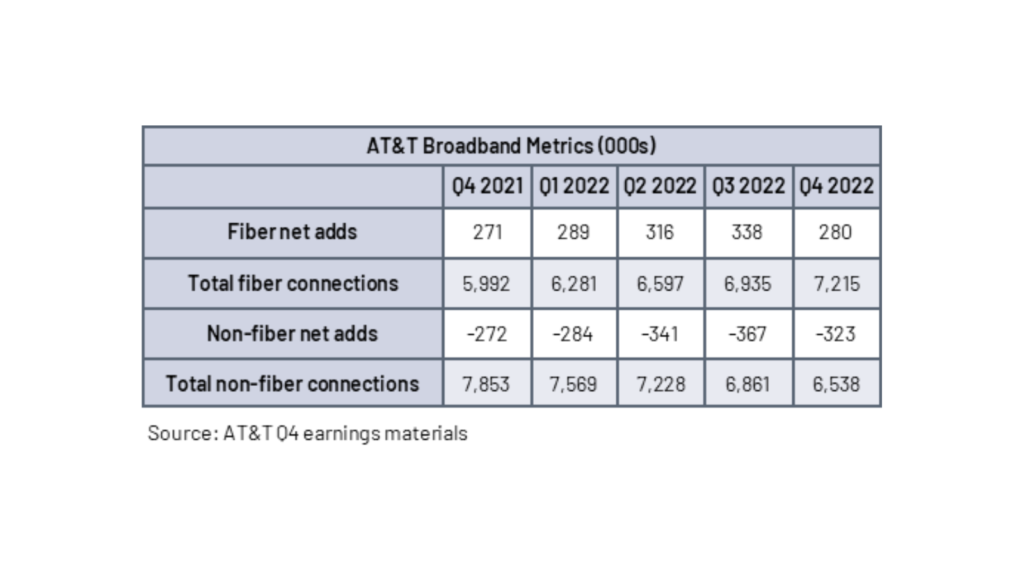

AT&T added 280,000 new fiber subscribers in Q4, a 3.3% increase from a year ago and the company’s 12th consecutive quarter with more than 200,000 net fiber adds.

Impact: But the fiber gains AT&T made in Q4 were its lowest quarterly fiber net adds of the year and came in 17% lower than the 338,000 fiber subscribers the company added in Q3. The fiber net additions in Q4 pushed AT&T’s total fiber subscriber base over the 7 million mark to close the year at more than 7.2 million on the strength of 1.2 million fiber additions during the year. Per CEO John Stankey, that made 2022 the fifth straight year AT&T added more than 1 million new fiber subscribers. He also noted that AT&T’s fiber base now outnumbers its combined non-fiber broadband and DSL customer base. Meanwhile, AT&T’s non-fiber customer base continues to shrink, declining to 6.5 million after losing 1.3 million customers in 2022. AT&T also lost more non-fiber customers than it added in fiber subscribers, leaving it with a net broadband loss of 43,000 for the quarter, a figure that doesn’t even include its DSL results because AT&T classifies its legacy copper service separately from broadband. AT&T reported negative total broadband subscriber growth in three of four quarters in 2022 as even strong fiber gains couldn’t overcome the burgeoning non-fiber losses.

AT&T continued its fiber expansion efforts in Q4, adding 600,000 new locations to push its total number of consumer fiber locations to 19.1 million. That pairs with more than 3 million business fiber locations for a total of at least 22.1 million fiber passings. This puts AT&T well on its way to meeting its goal of 30 million fiber passings by year-end 2025 if it’s able to add approximately 2 million to 2.5 million each year. AT&T also has two additional planks in its fiber strategy: the December 2022 joint venture with private equity group BlackRock Alternatives to build an out-of-footprint wholesale fiber network and the billions in federal broadband funding coming from the $42.5 billion Broadband Equity, Access, and Deployment program later this year. With Gigapower, AT&T plans to start small with a target of 1.5 million locations to see how the buildout process goes and then slowly expand service to additional locations. Stankey indicated that this strategy is based in caution so as to not spook investors who aren’t familiar with the wholesale model Gigapower will employ. Regarding BEAD funding and other federal and state broadband awards, Stankey made it clear that AT&T plans to go after some of that money to perhaps add on to its fiber passings total. But he doesn’t expect to start any projects with that funding until at least next year, although AT&T anticipates some initial projects awards could be passed out by the end of this year.

Aside from the fiber updates, the biggest broadband-adjacent news out of AT&T’s Q4 earnings call related to 5G fixed wireless access service, something AT&T has resisted deploying even as T-Mobile and Verizon have made big gains with their own 5G-powered FWA products. But things have changed, and Stankey reported AT&T will dip its toe further into the fixed wireless pool in 2023 with a new mid-band FWA product it will use to cover areas where it won’t deploy fiber (and likely plans to ditch its legacy copper network). AT&T’s C-band deployment has also accelerated, with AT&T reaching 150 million people with the mid-band spectrum at the end of last year. This puts AT&T well ahead in its buildout schedule as it works toward its goal of covering 200 million by year-end 2023. The faster-than-projected C-band deployment could be why AT&T waited until now to dip its toe into the 5G FWA fray.