It seems like every day there’s a new headline proclaiming good news or bad news for low earth orbit satellite Internet provider Starlink, part of the SpaceX family of companies.

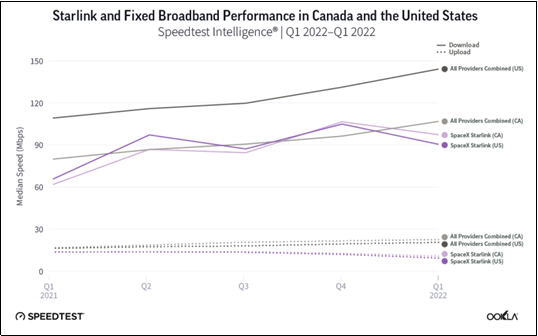

Impact: The most recent evidence of that comes from a recent Ookla report using Q1 data from its Speedtest platform. On one hand, Starlink’s median U.S. download speeds increased by 38% over the past year, rising from 65.72 Mbps in the first quarter last year to 90.55 Mbps in this year’s opening quarter, which would seem to be a significant achievement. On the other hand, the company’s median download speed fell by roughly 14% sequentially in the first quarter after hitting 104.97 Mbps in Q4 2021, which raises concerns. While that might not seem like such a big deal for a satellite Internet provider still deploying satellites to fill out its network constellation, the median speed for the industry came in at 144.2 Mbps. But more importantly, Starlink’s nearly $900 million in funding from the 2020 Rural Digital Opportunity Fund auction hinges on what speeds it can guarantee in the areas where it committed to provide service.

Upload speeds are marginally less important in the RDOF scheme of things, but no should overlook the fact that Starlink’s median upload speeds dropped 22.5% year-over-year to 9.33 Mbps in Q1 even as fiber operators deploy networks capable of symmetrical multi-gigabit speeds. Speed is a problem for Starlink because it committed to delivering a minimum of 100/20 Mbps broadband speeds in areas where it won the bidding. Providers could bid based on speed level commitments, including 25/3 Mbps, 50/5 Mbps, 100/20 Mbps, and 1 Gbps/500 Mbps. According to the FCC, 99.7% of the bids came in at least at the 100/20 Mbps level with 85% committing to gigabit service. That means Starlink must consistently offer speeds at or above 100/20 Mbps or risk losing the funding.

The FCC is still, a year and a half later, going through all of the winning bids to confirm providers can meet their commitments. Starlink is one of the few top 10 winners with no funding authorized yet, and it may still join the likes of others that have defaulted on their bids. That might validate a loud consensus among competitors before, during, and after the auction that satellite and fixed wireless operators shouldn’t have been allowed to bid in the first place. We should also note that one of those competitors, Viasat, recently launched a new plan lineup with a top-level speed of 150 Mbps. Starlink late last month reported more than 400,000 global subscribers, leading to speculation its network suffers from congestion issues. A late June PCMag article pinned Starlink’s subscriber count at closer to 500,000.

Starlink also continues to face challenges on a number of regulatory fronts, from a recent FCC filing by Amazon regarding the size of Starlink’s upgraded satellite constellation to opening up the 12 GHz spectrum band for 5G use. With Amazon working on its own low earth orbit satellite Internet network, it’s no surprise it wants the FCC to constrain Starlink’s expansion plans. Amazon’s filing calls for the Commission to address a variety of issues raised by adding 30,000 new satellites to the sky and asks that conditions be imposed on Starlink’s network. It’s likely, however, that Starlink likely needs the next generation of satellites that will comprise the larger constellation to increase its speed capabilities so that it can collect on its winning RDOF bids.

In the 12 GHz band dispute, Starlink has been jostling with Dish, RS Access, and numerous smaller wireless providers in a group called 5G for 12 GHz Coalition about the desire to open up the band to two-way use. The band is currently only available to satellite operators under rules governing one-way use, with both Starlink and Dish already active in the band. Starlink opposes opening it up for 5G, citing its importance to its operations, while Dish wants more spectrum for its greenfield 5G network and sees the 12 GHz band as a perfect way to gain additional spectrum. Starlink recently submitted analysis that shows 5G service in the band would result in interference of its planned satellite Internet operations, contrary to reasoning submitted by Dish and others that the band can support both uses. Meanwhile, Dish and RS Access have their own report supporting their position on the matter. With a complicated, technical debate, there’s no telling when the FCC will decide what to do with the band, but it’s a good bet one side will be extremely unhappy once a ruling is finally made.