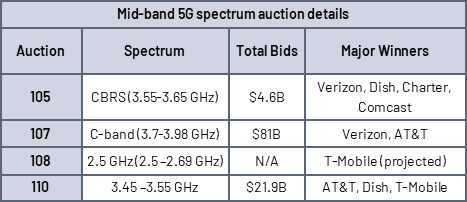

Wireless carriers pushing for more mid-band spectrum to use for 5G have gotten their wish, as the Federal Communications Commission has expedited its plans to auction off the remainder of 2.5 GHz spectrum.

Impact: If that spectrum band sounds familiar, it’s probably because that’s the band T-Mobile acquired in its merger with Sprint and has since leveraged to build a commanding lead over rivals AT&T and Verizon in 5G. While T-Mobile doesn’t own all of the licenses it’s using in the 2.5 GHz band, it is the dominant player and projected to be the highest bidder in Auction 108.

The auction will start July 29, at which time bidders will vie for approximately 8,000 new county-based overlay licenses. The licenses are designated as flexible-use and will be auctioned off in a multi-round, ascending clock format, something T-Mobile had been pushing for. The available licenses will cover “white spaces” where no one currently owns the spectrum, which has traditionally been designated for educational usage, and cover more rural parts of the country. This dovetails nicely with T-Mobile’s two-year plan to extend its mid-band Ultra Capacity 5G network to rural areas of the country.

The ascending clock format should help T-Mobile easily target licenses based on where it lacks coverage. The overlay designation for the licenses means that operations of incumbent licensees, such as tribal users, are protected within the auctioned areas. The overall goal of Auction 108, according to FCC Chairwoman Jessica Rosenworcel, is to fill in 5G gaps in rural areas and “help deliver on the promise of 5G services and ensure that it reaches as many people as possible.” The FCC also plans to use a new mapping tool to determine where unassigned 2.5 GHz spectrum exists in a given county.

Wireless carriers other than T-Mobile are likely displeased with the way the FCC has structured the auction, especially given recent filings from AT&T and Verizon complaining about T-Mobile’s bidding advantages in the band. Both AT&T and Verizon say they need to know some of the terms of T-Mobile’s leases in the band in order to make informed bids of their own, although it’s not yet clear whether either will even participate in the auction. Of course, we know from earlier comments that T-Mobile considers its spectrum lease terms to be trade secrets, with threats of legal action against any spectrum owners that reveal any terms.

While the county-sized licenses should be more affordable to smaller bidders than the partial economic area (PEA) designation the FCC has used in previous 5G auctions, the multi-round approach isn’t considered as friendly to smaller bidders as a sealed bid approach. To counter that, the FCC will offer bidding credits to smaller providers: a 15% discount for rural service providers with fewer than 250,000 combined wireless, wireline, broadband, and cable subscribers; 15% for small businesses based on average annual gross revenue; and a 25% discount for very small businesses, also based on average annual gross revenue.

Whether the auction rules help smaller bidders grab some additional mid-band spectrum or end up granting T-Mobile near total control of the 2.5 GHz spectrum band, the move to free up more spectrum for 5G use, especially in areas where wireless service can be slow and spotty, should result in improved coverage for the less populated parts of the country.